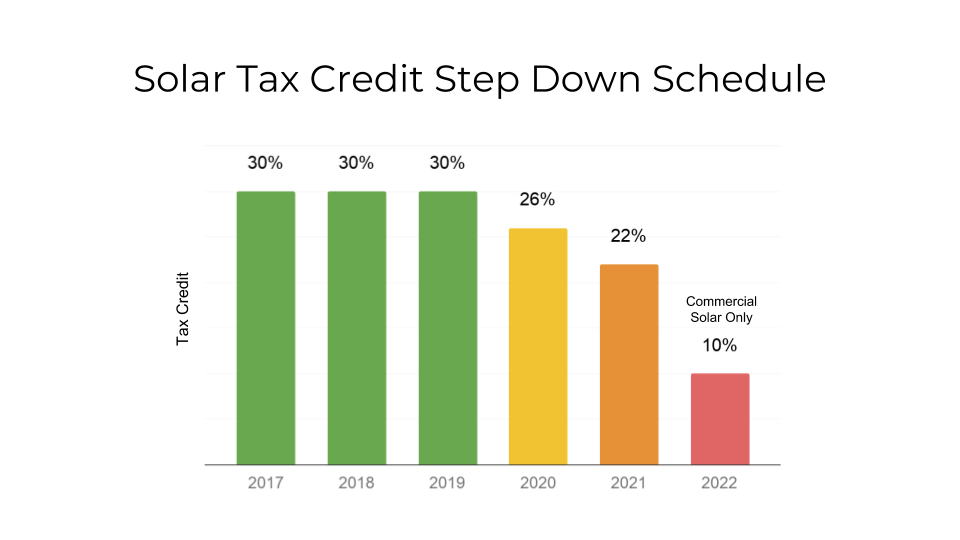

Tax credit ending! Tax credit was cut from 30% to 26%. It will go be reduced again to 22% next year, and then it’s gone!

Fortunately, if you haven’t begun your solar project yet, The Federal Solar Tax Credit (also known as the Investment Tax Credit or ITC)is still available to you. The tax credit will “sunset”. This means it will gradually decrease in the percentage of the project’s total cost applied to your tax bill over the next two years.

- 2020 projects are granted a 26% tax credit,

- dropping to 22% in 2021,

- 10% in 2022,

- and zero for residential solar after that.

As far as commercial installations go, the commercial solar tax credit is the same as the residential tax credit up until the end of 2021. After January 1, 2022, the commercial and utility solar ITC will reduce and hold at 10% indefinitely. If no new legislation is implemented, the ITC will disappear for residential projects in 2023.

While a 4 percent drop may not seem like much, it means thousands of dollars in savings when you’re investing ina solar panel system. For some, the difference between claiming the ITC in 2020 and 2021 may be less than $1,000. But the larger your system is, and the higher the cost of solar is in your area, the more you stand to lose from the ITC decrease.

Most importantly, the solar tax credit helps you save money even during the installation of the solar system. You start saving money from day one.

Installation costs include the system, labor, fees, taxes and certain corrective costs to enable installation of the system. Even the fees that go into consultations with a professional solar energy expert count as part of the installation costs.

How is the ITC calculated?

The credit is a dollar for dollar income tax reduction.

This means that the credit reduces the amount of tax that you owe.You simply subtract your credit amount from the total tax the IRS says you must pay.

How do you qualify?

You must meet a few requirements during the tax year:

- You mustinstall it by Dec. 31, 2020.

- You must own and not rent the home or business -a rental property does not qualify.

- You must own the solar panels. Leasing disqualifies you.

You claim the investment tax credit for solar when you file your yearly federal tax return, by completing IRS forms 1040 and 5695 (please consult your accountant during so).

To get a free estimate on a home improvement project and see if you qualify for the ITC, visithttps://floridasmartenergy.com/